Fiserv’s Nightmare Week Shakes the FinTech Market

Hey FinTech Fanatic,

One of FinTech’s biggest names just suffered its worst week on the market.

Fiserv shares plunged nearly 47% after the company slashed its full-year guidance, missed earnings expectations, and announced a major leadership shake-up.

For a company long seen as a pillar of stability in payments, the collapse marks a sharp loss of investor confidence. Read more in this post.

👇 Here’s how other listed FinTech companies performed this week.

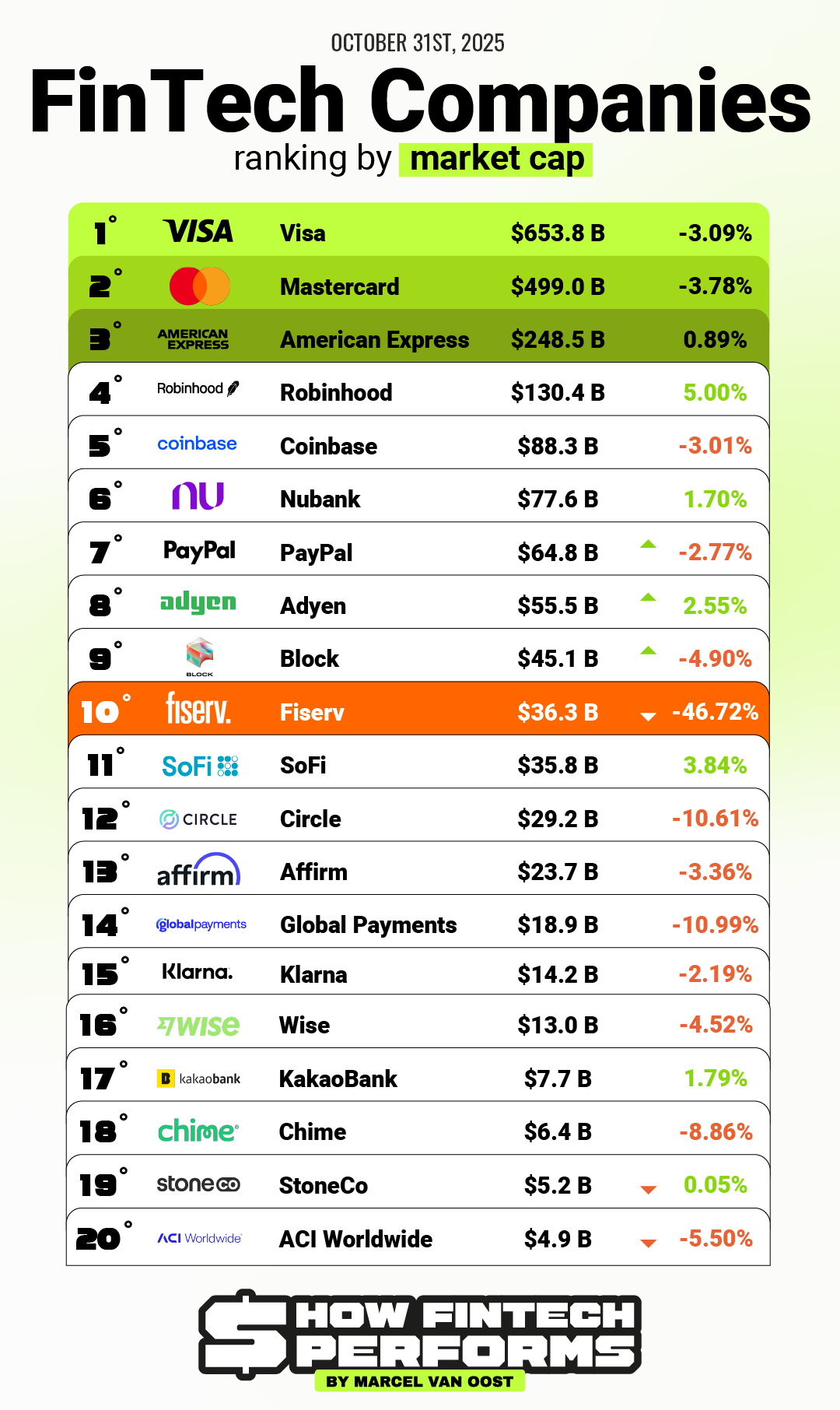

🏦 FinTechs by Market Cap

The leaderboard stayed mostly stable at the top.Visa ($653.8B, –3.09%) and Mastercard ($499.0B, –3.78%) led the market, followed by American Express ($248.5B, +0.89%).

Other names saw sharper moves, with Robinhood ($130.4B, +5.00%) climbing into fourth place — overtaking Coinbase ($88.3B, –3.01%) — while Fiserv ($36.3B, –46.72%) dropped to tenth after its record-breaking sell-off.

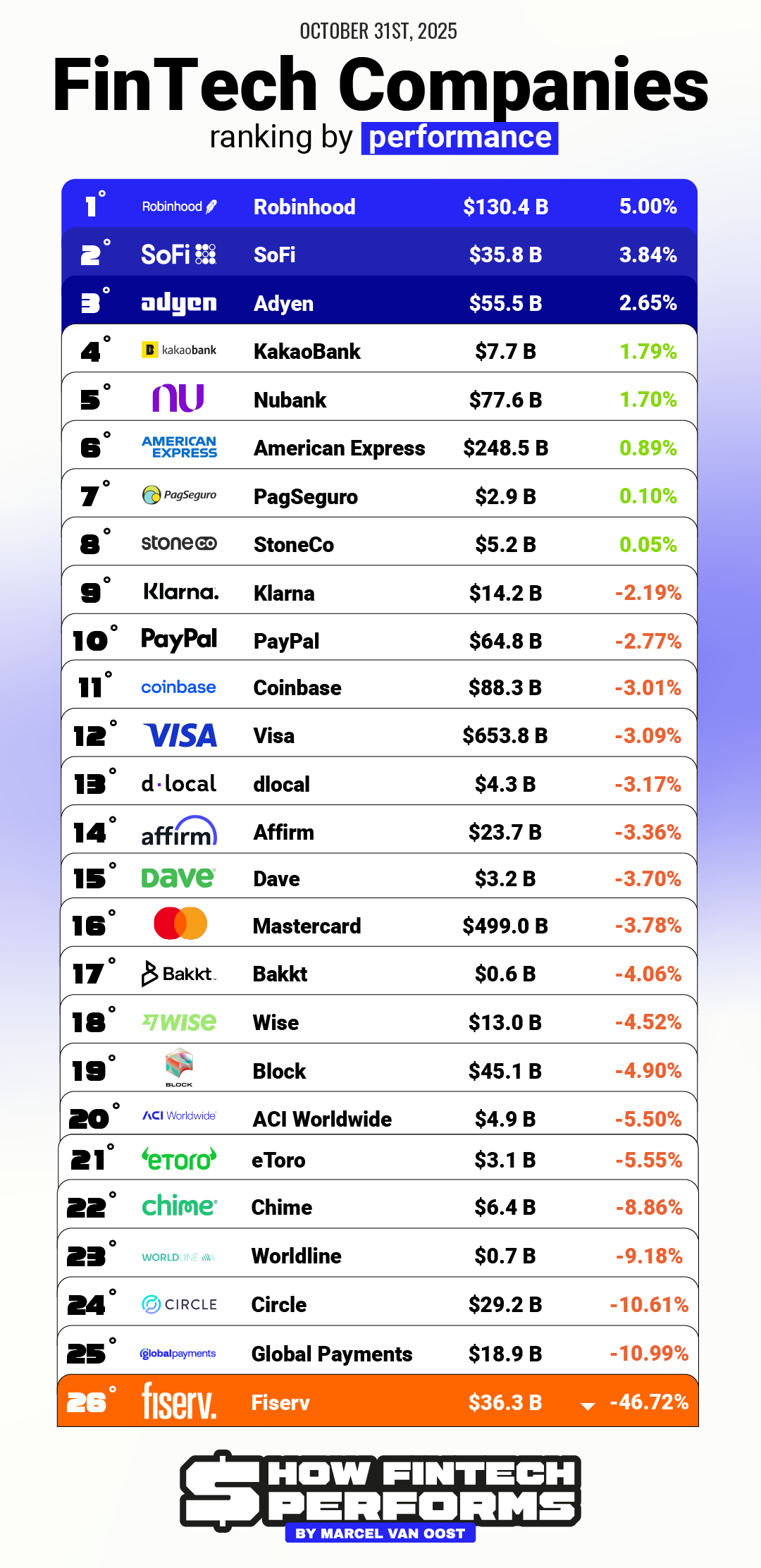

📈 FinTechs by Performance

When it came to performance Robinhood (+5.00%), SoFi (+3.84%), and Adyen (+2.65%) led the gains, with KakaoBank (+1.79%) and Nubank (+1.70%) rounding out the top five.

At the other end, Global Payments (–10.99%), Circle (–10.61%), and Fiserv (–46.72%) marked the steepest declines in performance.

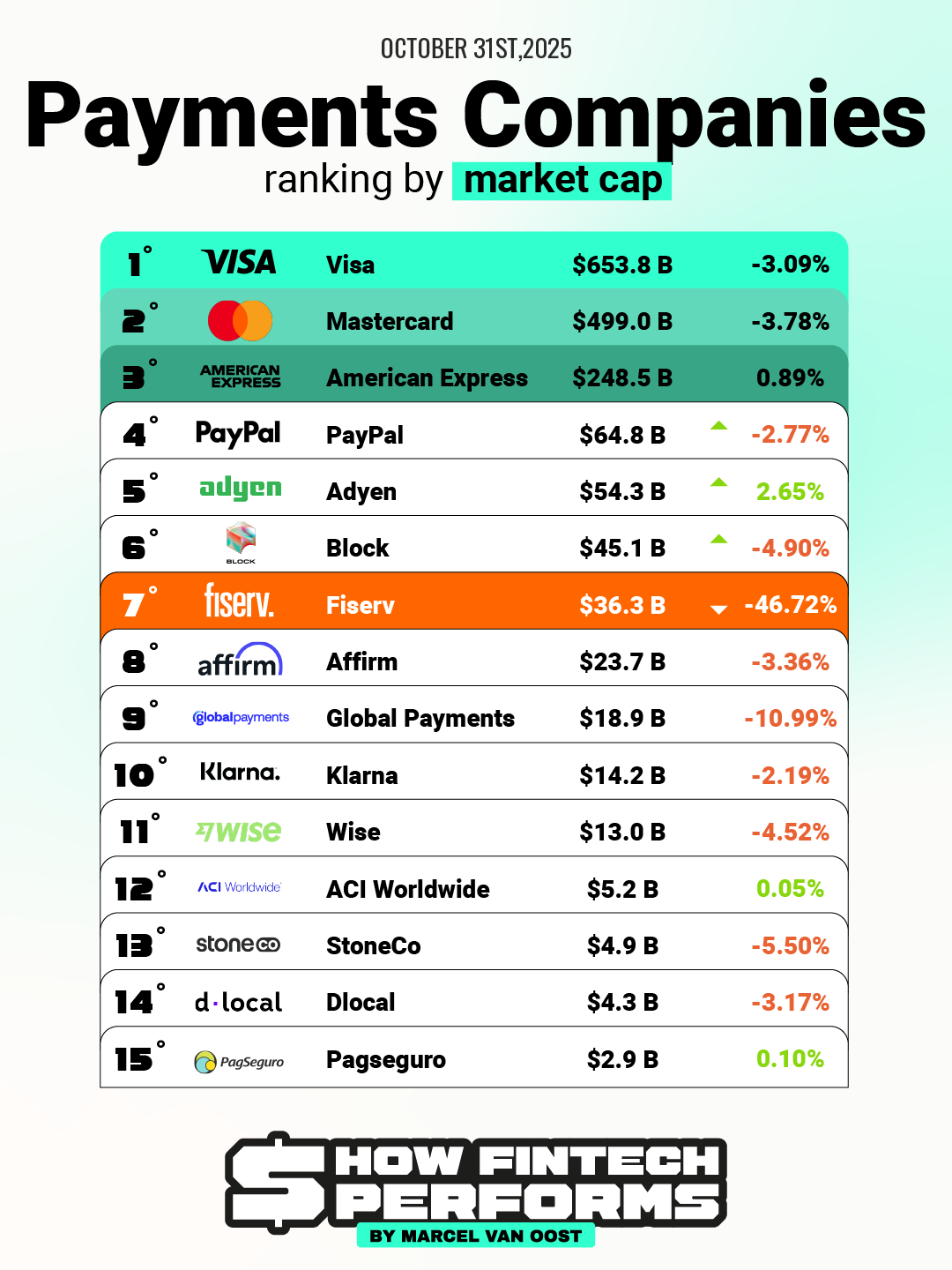

💳 Payments by Market Cap

Payments companies faced a rough week overall.

Visa ($653.8B, –3.09%) and Mastercard ($499.0B, –3.78%) held the top spots, while American Express ($248.5B, +0.89%) showed rare resilience.

Adyen ($54.3B, +2.65%) was the only notable gainer, contrasting sharply with Block (–4.90%), Global Payments (–10.99%), and the staggering Fiserv (–46.72%).

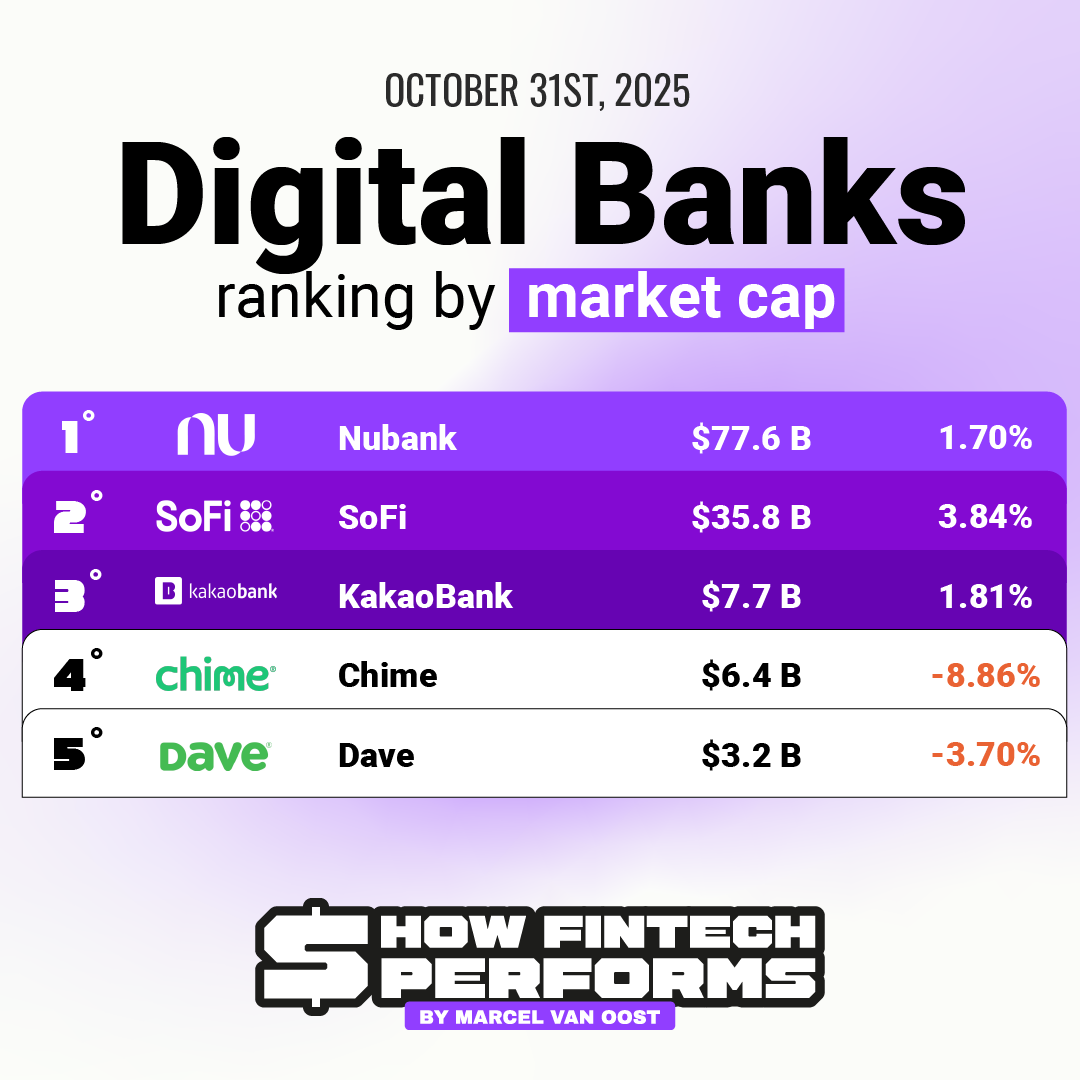

🏦 Digital Banks by Market Cap

Digital banks mostly held steady this week.

Nubank ($77.6B, +1.70%) stayed in the lead, followed by SoFi ($35.8B, +3.84%) and KakaoBank ($7.7B, +1.81%).

Chime (–8.86%) and Dave (–3.70%) slipped lower amid broader weakness in small-cap aFinTechs.

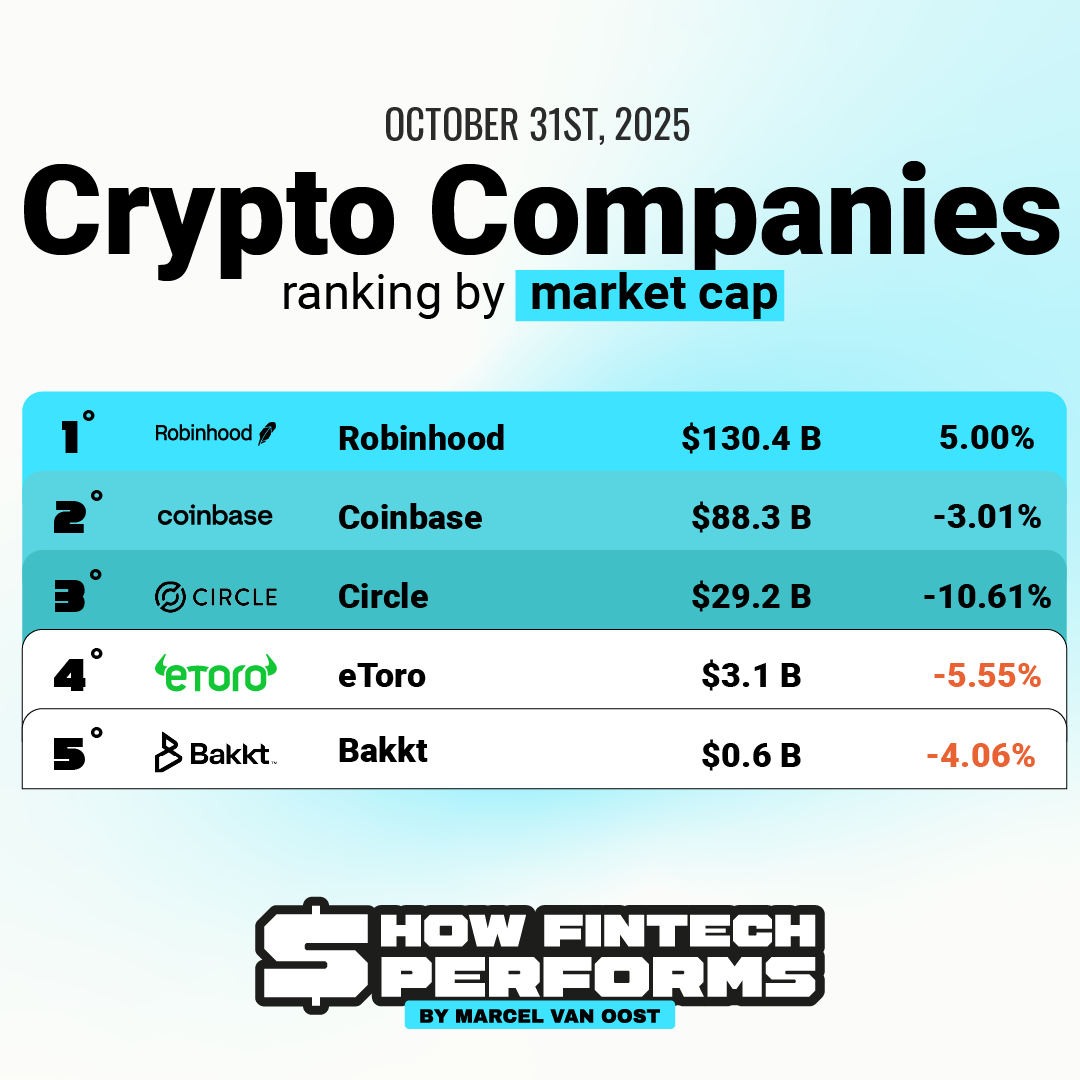

🪙 Crypto Companies by Market Cap

Crypto names were mixed but less volatile than payments stocks.

Robinhood ($130.4B, +5.00%) extended its lead over Coinbase ($88.3B, –3.01%), while Circle ($29.2B, –10.61%) and eToro (–5.55%) struggled.

Bakkt ($0.6B, –4.06%) continued its gradual decline after weeks of sharp swings.

To summerize, this week was dominated by Fiserv’s sharp decline, which weighed on the broader Payments sector and dampened sentiment across FinTech.

Still, select names, including Robinhood, SoFi, and Adyen, managed to post gains, signaling that investor confidence remains uneven but not absent.

Comments ()